Problem Statement

It’s no secret the coronavirus and recent Geo-Political Risks has completely shaken up life as we know it. It has affected people, businesses, and industries in ways that no one could foresee. During these unprecedented times, we need to return to the basics and take action to respond to economic crisis heading towards a recession.

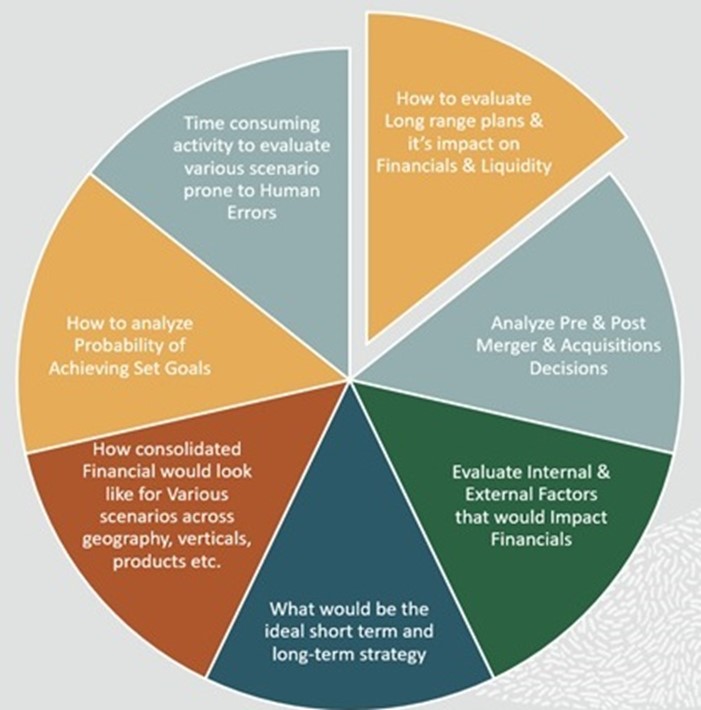

Organizations who understand the scenario and its impact and react with speed and enthusiasm will emerge stronger than ever from the crisis. Many Organizations have started taking aggressive strategies to address challenges resulting due to economic crisis. Below are the questions Executives are seeking answers for below listed questions.

Scenario Analysis & Drawbacks of Conventional Scenario Analysis

Scenario Analysis helps to identify and analysis the possible best-case and worst-case scenarios that would result due to unexpected economic, geopolitical, and technological challenges

The best-case scenario takes into consideration what will happen if everything goes as planned by the Organisation whereas worst-case scenario includes the impact on the financials if things go negatively due to any external and internal factors. Traditional Method of Scenario Analysis through excel spreadsheets makes the process much complex which results into following drawbacks.

- Numerous meetings and workshops are needed to identify the various possible scenario and its occurrence which makes the process more time consuming.

- Due to manual process, it requires more resources in terms of time and investment that make the process costly.

- It is very difficult to accurately quantify the variables in terms of financial value even though the variables are known due to the nature of the variable which differs over time.

These and other constraints led many organizations to adopt various forms of computerized scenario planning solutions.

Steps to Perform Scenario Analysis

- Identifying the key assumptions underlying our forecasts and clearing presenting them in a robust planning model.

- Developing a base case.

- Identifying and modeling roughly 3-7 alternative scenarios and estimating their likelihood.

- Monitoring the critical assumptions listed in step 1 via a dashboard.

- Narrowing down and refining scenarios based as events play out.

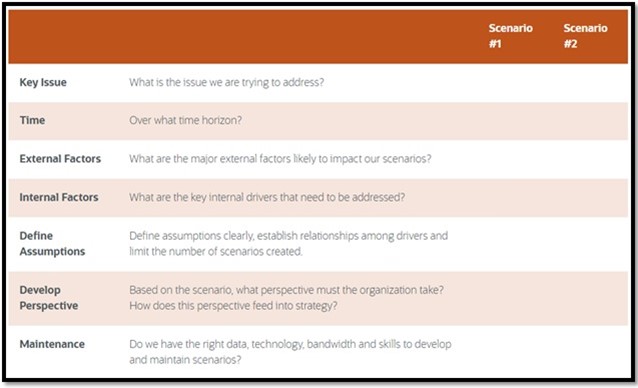

Scenario Analysis Matrix

Scenario Modeling with Oracle EPM

Scenario Modeling is built-in financial modeling functionality within Planning in Oracle Fusion Cloud EPM that addresses this problem. It enables users to quickly create long-range forecast models for fast-changing business dynamics using built-in sophisticated scenario modeling capabilities and debt and capital structure management features. Scenario Modeling is built within the Oracle Fusion Cloud EPM platform, and users can work within the familiar Smart View and Web Interface.

Key Features

- Scalable & Robust

- Mix and Match Consolidation Scenarios

- Built-in Industry specific Templates along with option of customizing as required.

- Built In Financial logic and accounting Integrity

- Quick Reporting & comparative analysis between what-ifs

- Integration capabilities with EPBCS modules as well as reporting platform.

- In built features of Forecast Methods, Translation, Goal Seek, Simulation & Audit Trails with strong modeling capabilities.

- User Security and accessibility.

Camptra’s Solution Offerings

Solution provides framework to quickly create long range forecast solutions for what-if modeling of business risk. It provides numerous scenarios which can be leveraged by business. It enables business to make the key decisions they need, purpose-built capabilities.

Solution Overview

- Forecast for multiple scenarios e.g., Quick Recovery, Delayed Recovery or Prolonged Recovery or Best and Worse and Ideal Case Scenarios

- Produce reliable credit metrics calculations across all scenarios

- Understand Balance Sheet and Cash Flow impacts to preserve liquidity and financial flexibility

- Blended scenarios on payment delays, inventory fluctuations, etc.

Business Benefits

- Prebuilt financial intelligence for sophisticated what-if modeling

- Completely integrated with annual financial and operational plan

- Current economic situation requires a scenario modeling solution that can assess the wide array of possible outcomes

- Cash Flow forecasting and capital structure scenario modeling

- Scenario run time reduced from days to minutes

- Alignment of strategy of execution through tight integration of strategic targets to short term tactics in plan

Moving to a Cloud Enterprise Solution certainly looks to be the way forward. Selecting the right experienced partner is key. As an Oracle only partner with numerous global implementations across various industries, we understand what it takes for a smooth transformation. Our consultants are highly experienced, certified, and motivated to help you succeed in your journey to the cloud. We have the right tools and expertise to get it right the first time GUARANTEED.