How to Seamlessly Migrate Your Payroll Tax Engine Before the April 2026 Deadline

Introduction

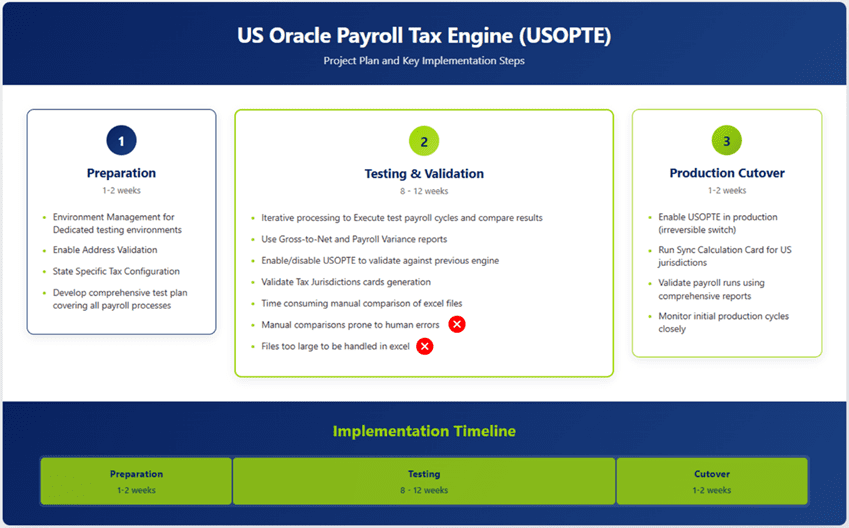

Oracle’s transition from the Vertex Payroll Tax Engine to the Oracle Payroll Tax Engine (OPTE) marks a major shift in payroll tax management. With Vertex support ending in April 2026 under Oracle Cloud Release 26A, organizations must prepare now to avoid compliance issues and payroll disruptions.

At Camptra Technologies, we guide enterprises through this migration with a structured approach that reduces risks, simplifies testing, and ensures accuracy. This article focuses on the step-by-step migration process, helping you plan and execute a smooth transition.

1. Why Migrate to OPTE

OPTE introduces a modernized payroll tax framework designed to improve compliance, accuracy, and integration within Oracle Cloud HCM. Some of the key advantages include:

-

- Native integration with Oracle Payroll

-

- More accurate jurisdiction detection using geospatial mapping

-

- A single-page view of employee work and resident tax addresses

-

- Faster updates with minimal downtime

-

- Better control over payroll tax calculations and legislative updates

Migrating early ensures organizations avoid last-minute challenges and benefit from improved efficiency and automation.

2. Preparing for the Migration

Before starting the migration, proper preparation is essential to reduce errors and ensure data consistency.

Step 1 — Set Up the Test Environment

-

- Use a dedicated test pod for OPTE validation.

-

- Schedule regular data refreshes from production to keep the test environment current.

- Create a comprehensive test plan, including validation steps, expected results, and reporting checkpoints.

3. Oracle’s Migration Framework

Oracle provides a structured process to switch from Vertex to OPTE efficiently.

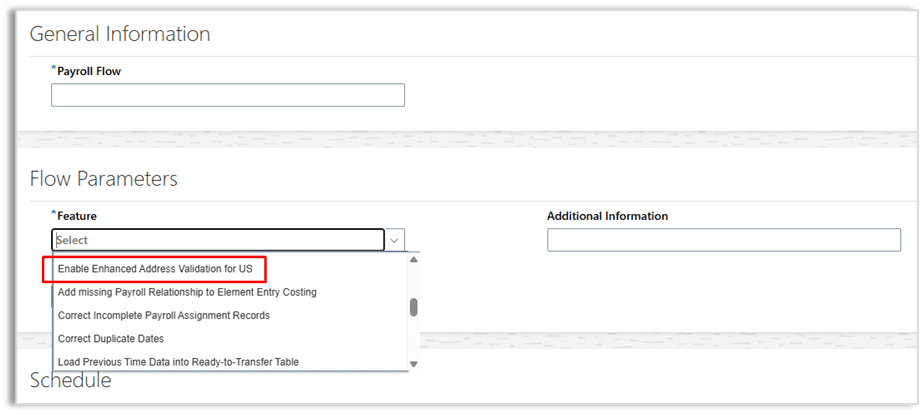

Step 2 — Enable Enhanced Address Validation

Navigate to: Setup and Maintenance → Manage Features by Country or Territory

Note: If you are not seeing the option in the Manage Features, run the Run Feature Upgrade payroll flow. When searching for the flow make sure to the legislative data group value blank.

Step 3 — Run the Load Geographies Process

-

- Navigate to: My Client Groups → Payroll → Submit a Flow → Load Geographies

-

- Purpose: Updates Oracle’s master geography dataset for accurate jurisdiction mapping.

-

- Parameters:

-

- Legislative Data Group (LDG): Select your U.S. LDG

- Geography Type: All Geographies

Step 4 — Validate Employee Addresses

-

- Navigate to: My Client Groups → Payroll → Submit a Flow → Address Validation Process

-

- Purpose: Ensures accurate tax jurisdiction mapping.

-

- Recommended approach:

-

- First run in Draft Mode → Review and correct invalid addresses.

- Then rerun in Final Mode.

Step 5 — Run Initial Configuration Processes

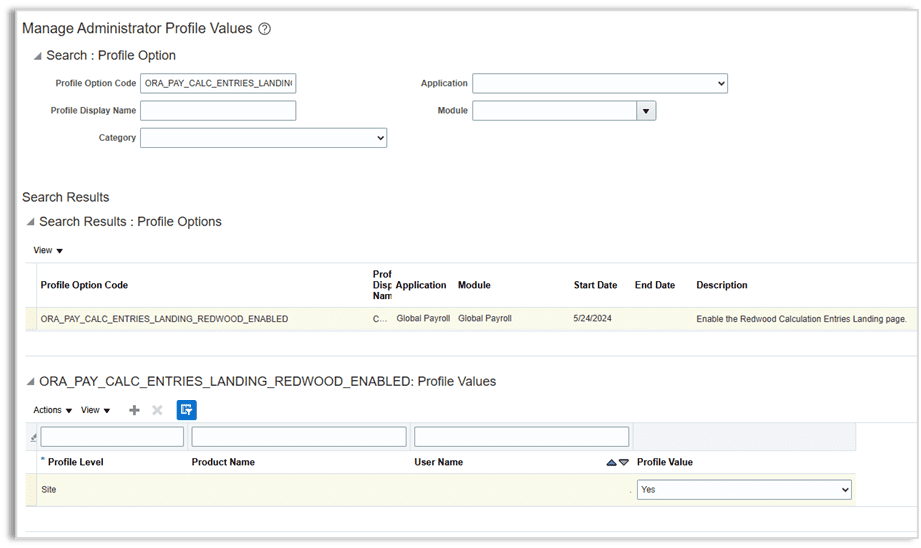

a) Enable Redwood Calculation Entries

-

- Navigate to: Setup and Maintenance → Manage Administrator Profile Values

- Set Profile Option Code: ORA_PAY_CALC_ENTRIES_LANDING_REDWOOD_ENABLED → Value: Yes

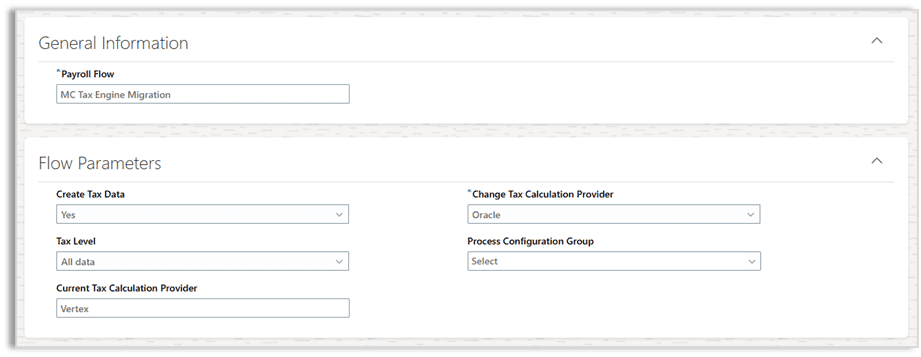

Manage Tax Engine Flow

-

- Navigate to: My Client Groups → Payroll → Submit a Flow → Manage Tax Engine

-

- Parameters:

-

- Payroll Flow Name: “Enable OPTE Migration”

-

- Create Tax Data: Yes

-

- Tax Level: All Data

-

- Change Tax Calculation Provider: Oracle

Validate OPTE Installation

-

- Navigate to: My Client Groups → Payroll → Values Defined by Criteria

- Verify that US_NGTAX data is returned, confirming OPTE activation.

Step 6 — Sync Calculation Cards

-

- Navigate to: My Client Groups → Payroll → Submit a Flow → Sync Calculation Cards

-

- Purpose: Copies jurisdiction data to tax withholding cards.

-

- Recommended options:

-

- Sync Local Jurisdictions

- Sync Pennsylvania PSD Codes (if applicable)

Step 7 — Set the Earnings Accumulation Transition Date

-

- Navigate to: My Client Groups → Payroll → Payroll Process Configuration

- Set the date one day after the last Vertex payroll run to avoid mismatches.

4. Testing Strategies

Testing ensures a smooth transition and accurate tax calculations. Oracle supports two approaches depending on Create Accounting usage:

Path A: Create Accounting Used

-

- Reload timecards into a cloned test environment.

-

- Run reconciliation tests before switching to OPTE.

Path B: Create Accounting Not Used

-

- Roll back and rerun payrolls within the same period under both Vertex and OPTE.

- Easier comparison and reduced setup adjustments.

5. Pre-Migration Reports and Best Practices

Before switching, generate these reports under Vertex for each payroll period:

-

- Payroll Activity Report (CSV recommended for large datasets)

-

- Statutory Deduction Register

-

- Employee Active Balance Reports

-

- Tax Calculation Reports (optional)

Best Practices:

-

- Organize reports by Engine → Pay Period → Report Type.

-

- Ensure time zones and effective dates are consistent.

- Store reports in a version-controlled repository for traceability.

6. Finalizing the Switch to OPTE

After completing setup and testing:

-

- Rerun payrolls using OPTE.

-

- Generate the same reports under OPTE as done under Vertex.

- Compare outputs to validate accuracy and identify discrepancies early.

Conclusion

Migrating from Vertex to OPTE is a critical step for organizations using Oracle Cloud Payroll. By following Oracle’s structured migration framework, preparing thoroughly, and performing robust testing, businesses can ensure a seamless transition while maintaining accuracy and compliance.

In the next article, we’ll explore how Camptra’s advanced reconciliation toolset simplifies testing, automates comparisons, and accelerates the validation process.