Historically Assets have been treated as an afterthought –managers pay attention only when something goes wrong. One wrong decision in terms of capital investment would prove Fatal to organization as whole. Of late Enterprises are realizing that there should be an appropriate and robust mechanism to track the Capital Investment already made, and the capital investment which is going to be made in the future.

- Inadequate transparency in Capital Investment

- Cross-Functional Teams gets the proposed capital budgets too late

- No tracking of capital investments with the Organization’s Funding Capacity

- Difficult in mapping Capital Spending with Organization’s Strategic Plan

- Inadequate Capital Requests trends to surpass Capital Budgets

- Manual and Time-Consuming process tends to Human Errors

What is Capital Planning – EPBCS

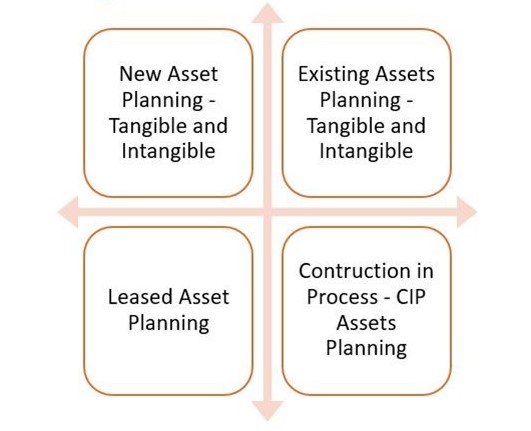

With the aid of Oracle EPM Capital Planning, we can manage the Capital Assets. Capital Planning addresses the need associated with new and existing assets including intangibles. The Capital Asset business process builds upon the long-established Oracle Capex application module and adds new capabilities to manage existing assets and request new assets for future strategic needs. Using Capital Asset Planning, users can perform a task such as

- Perform Driver based Calculation to assess the influence of changes and addition of Capital assets

- Requesting and approving Capital Expense plans

- Anticipating the impact of Transfers, Impairment, and Retirement on the Financial Statement.

- The Product also allows to define its custom element to accommodate any specific requirement

- Strategic decision makings like funding and Investment

- Buy v/s Lease comparison

Capital Planning Process in EPBCS

Existing Assets Planning

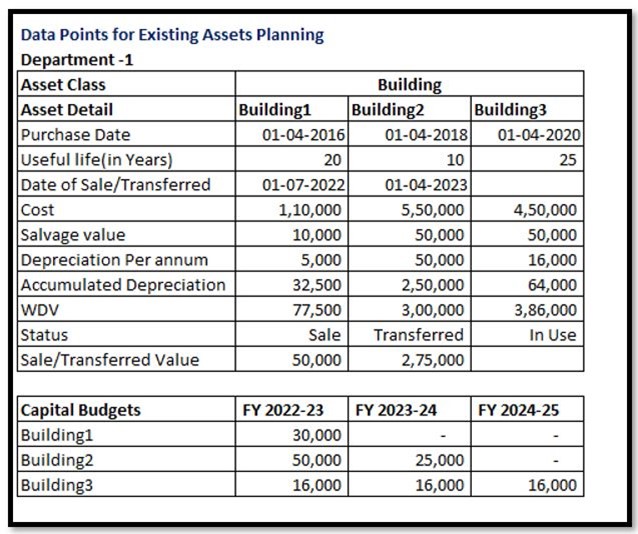

Existing assets are those assets that Form Part of the Capital asset portfolio of an organization. A Capital module of Oracle cloud EPM facilitates planning for existing assets. Planning for existing assets put light on various expenditures which are going to be incurred by the organization on various assets in the form of Depreciation, repairs, Maintenance, insurance, and others.

Planning for Existing assets through lights on the assets that the organization is planning to dispose of in near future. With this input, management can plan to buy a new assets to replace the existing asset.

With the Existing Asset Planning, we can plan for Transfers, Retirement, Improvement, and Various expenditure such as Depreciation, Repairs, Maintenance, Insurance, and others.

Example: Consider a Company ABC Ltd having assets Building 1, Building 2 and Building 3. These would be classified as existing assets as they form part of Company’s Portfolio. The Organization is of the planning to Dispose of Building 1 in 2023-24, building 2 will be transferred to the Holding company in the year 2024-25 and Building 3 would be continued to be used.

As Building 1 is planning to be disposed of Profit/Loss would be calculated based on Sale value and written down value. All expenses related to it would cease to occur and with this information, Management can make a decision either to Purchase a new building in place of the old one or construct it to ensure that the work is not halted.

As Building 2 is transferred to the Holding company the expenses related to it would cease to be accounted in the books of ABC Ltd. Management needs to make a decision that the transfer of Building 2 does not impact the regular ongoing operations.

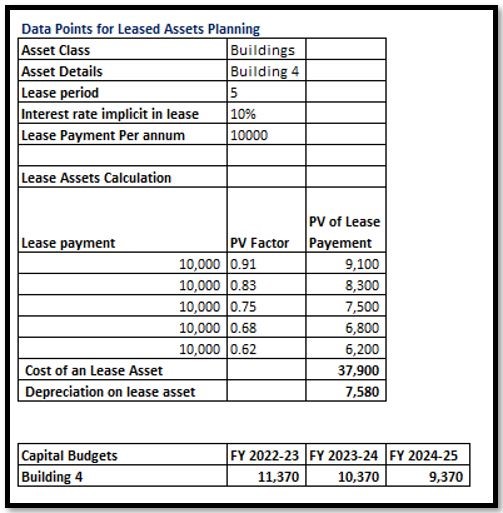

Lease Asset Planning

Oracle EPM Cloud allows to Plan for Lease transaction either on the Traditional method or by taking into consideration IFRS 16 which is the Latest Accounting standard on Leases. For Lease asset Planning we need to provide information such as Lease Payments, Does the asset gets transferred to Lessor at the end of Lease terms, the Interest Rate Implicit in the Lease, and the duration of the lease. If we have enabled IFRS 16 to Plan for Lease then we need to provide some additional details such as Low-Value Lease amount, Low-Value Lease term, and Index rate.

Example: ABC Limited is Planning to take Building on Lease, Lease Term is 5 Years, the Interest rate implicit in the lease is 10%, and the Lease payments per annum are 10,000 per annum. The Various cost associated with a Lease is Depreciation and Interest cost.

New Assets Planning

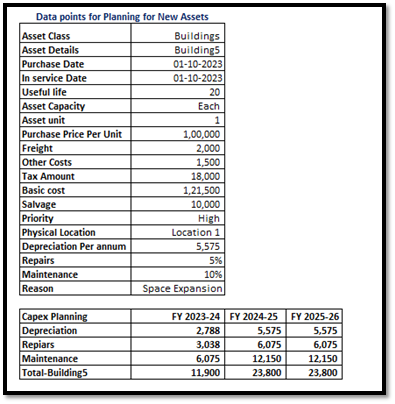

Oracle EPM Cloud provides facilities to Plan for New assets. New assets are those assets that do not form part of the company’s existing asset portfolio. The entity is planning to Purchase those assets either to replace the existing ones or to use those new assets to achieve the Strategic goals of the organization.

If the Organization is planning to expand its operation to another location, then a nee d to buy new assets to facilitate the operation will arise, therefore we Budget for the Purchase of new assets. Or if there are assets that the organization is of intention that these assets need to be replaced with new ones, we Budget for the Purchase of those assets. Planning for New assets is vital as it has a long-term effect on Profitability, Huge Investment is Involved, and decisions once taken cannot be undone. Oracle Cloud EPM Assists us in evaluating the new assets’ return on Investment, Payback period, and Net Present Value.

The following are the inputs required when planning for new asset.

- Assets Details and Asset Cost (Basic Cost, Freight, Additional Charges)

- Salvage value

- Number of units Purchased and Capacity of Asset

- Physical Location and Purchase reason code

- Justification for new asset purchased

Example: Consider a Company ABC Pvt. Ltd which wants to expand its Working Space, achieve the goal of expanding its working space are planning to buy a new Building. Purchase of new building should form part of Budgeting of next year. The description of the asset is Building5, the Cost is 1,10,000, the Salvage Value is 10,000, the useful life is 20 years, the Purchase date and in-service date is 1/10/2022 and the Location where the asset is located is Location 1 and the Justification is Requirement from the Department. From the input provided, we can Budget for Various Expenses such as the Cost of the asset, Depreciation, Repairs, maintenance, Insurance, and other expenses.

Connected Planning

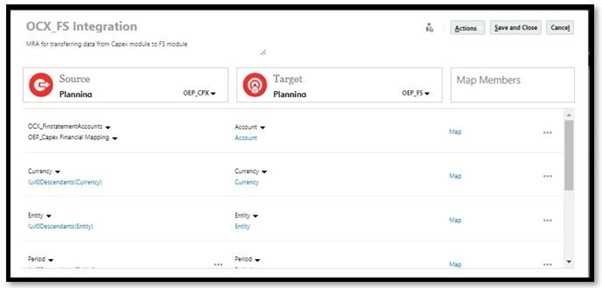

Oracle Cloud EPM allows users to Integrate the data from the Capital module into the financial module, users need to initially Map the capital account to the financial statement and then followed by creating a Data map under Data Exchange.

Your journey to Cloud with Camptra Technologies

Moving to a Cloud Enterprise Solution certainly looks to be the way forward. Selecting the right experienced partner is key. As an Oracle only partner with numerous global implementations across various industries, we understand what it takes for a smooth transformation. Our consultants are experienced, certified, and motivated to help you succeed in your journey to the cloud. We have the right tools and expertise to get it right the first time GUARANTEED.